• The economy has posted positive trends.

• This is despite the increased cost of living and contraction in the mining sector.

• Citizens should remain optimistic that they shall get over the current economic huddles.

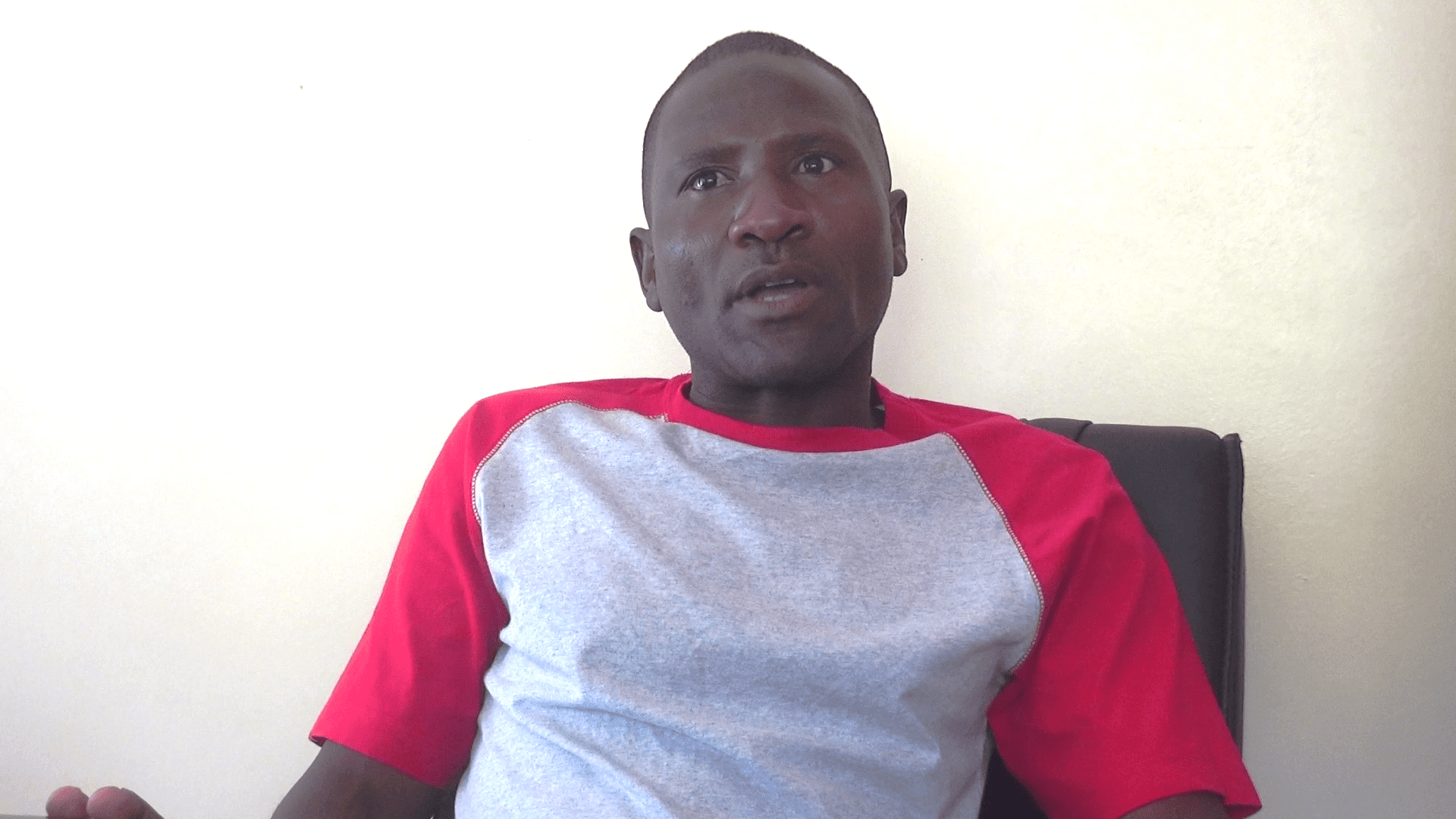

Inter-Africa Governance Network (AFRINET) says Zambia’s economic outlook remains positive despite the increased cost of living and contraction in the mining sector.

Organization Executive Director, Maurice Malambo told Money FM News that the economy has posted positive trends as documented by Citizens Economic Empowerment Commission (CEEC) in its loan recovery portfolio from 27% in June 2022 to 60% in the first half of 2023.

Mr. Malambo stated that this reflects availability of liquidity for recirculation into private sector growth and indicates viability of the funded entrepreneurial activities that ultimately contribute to the general enterprise in the economy.

He also noted that the decentralization Policy through Constituency Development Fund (CDF) has facilitated devolution of resources and entrepreneurial opportunities in the economy at constituency level.

“Such economic activities that are under the Centralized National Budget and traditional financial market would hardly be funded. This is crucial in giving citizens foothold in the economy and fostering a buoyant economy.”

“The Zambia Development Agency in the first half of 2023 alone recorded investment Pledges to the tune of US$14 Billion, the highest ever in the history of Zambia. As AFRINET, we attribute this huge figure in investment pledges to the inevitable international trips made by President Hakainde Hichilema and Government’s strategic Foreign Policy of non-alignment in which Zambia has moved from the perceived extreme East to the Centre in order to maximize the attraction of Direct Foreign Investment,” Mr. Malambo said.

He added that the recorded investment pledges is an endorsement of investor confidence and the positive investment climate in the country.

“Therefore AFRINET can only urge the Zambia Development Agency and other relevant institution stakeholders to collaborate in quick translation of these investment pledges into actual investment in the economy,” he stated.

He urged citizens remain optimistic that they shall get over the economic huddles despite the challenges of the moment.

Meanwhile, Mr. Malambo noted that the average 15% increase in fuel prices will result in an increase in the general cost of living especially for the low income bracket citizens.

He however said the major cause of petroleum pump price adjustment has been the considerably higher increase of petroleum cost on the international market due to the protracted Russia – Ukraine war and the disruption of oil supply from the Gulf of Mexico resulting from the experienced tropical storms and the anticipated hurricane

“The push factors are all external, making it a global phenomenon, as such is not failure of policy, however, these factors demand policy interventions on the local economic front in mitigation. This scenario demands policy intervention to buffer against the obvious direct negative impact of the ever prevailing external factors determinant of the local pump price and its ripple effects in the general economy.’

“In this regard, we retaliate our clarion position contained in the correspondence to Minister of Finance Situmbeko Musokotwane dated 5th September,2022, in which AFRINET advised in relation to the need to interrogate the propriety for the introduction of a Petroleum Pump Price Stabilization Fund, which is not a subsidy because it is not consumed in the economy, instead returned in the subsequent quarterly price review, failure of which the high artificial commodity prices may force the government to introduce a petroleum subsidy that is not sustainable and a distortion in the economy,” he added.

Energy Regulation Board (ERB) as revised a liter of Petrol from K25.57 to K29.42 and Diesel from K23.36 to K26.88, representing an average increase of 15% respectively.